TOP 5 Ways to WIN at Note Sales

I See Dead Deals. Here are the Top 6 Signs that your CRE deal is DEAD and what you need to do to stay away.

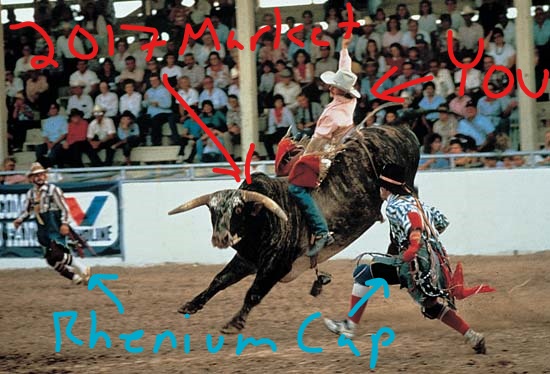

We were right on our predictions for interest rates heading into 2017. Here’s what the rest of this year’s CRE Bull Market will look like and what YOU need to do.

They say it’s a fools task to guess where interest rates will go. Well I’m your Huckleberry! Here are my Top 3 Predictions for Interest Rates

What BREXIT, the Chicago Cubs and Donald Trump Mean for 2017 and Beyond

The CRE industry can be a really tough business, but these five things make it so much harder than it needs to be for us. Yes, I know hate is a powerful word. But CRE

Finding your core, your passion, the things that keep you motivated isn’t always easy. Maintaining your passion and your focus can be tough sometimes, especially in the CRE game. But hey, if it were easy

In T minus 24 months the market will begin to see a 10% to 20% overall correction in asset prices. It may very well happen sooner. I still stand by my previous sentiments in Keep

Lehman collapsed in September 2008 and the bank bailout was quickly enacted the following October. Dodd Frank was signed into law in July 2010 and here we are in the summer of 2016 with the

Some on Wall St, main street and the banks feel that real estate has reached yet another high I tend to agree and that prices will inevitably come down. Prices have essentially peaked across the

The idea of a central bank in the United States has been a controversial topic since the days of Alexander Hamilton the guy on the $10 bill. And while many things have changed over the