Most investors think good deals go bad and turn into nightmares as a result of a series of consequences: bad luck, bad tenants, bad market, etc. I assure you that is NOT the case, and most nightmare deals were in fact bad deals from the start. Oftentimes issues go unemphasized, unchecked or completely unnoticed altogether only to later spiral out of control and turn your dream deal into a NIGHTMARE. So how do you avoid stepping into a bad deal? Well, we did create our Flashpoint and Catalyst reports for just that. But aside from shameless plugs, let’s give you a story of a note sale we recently advised.

As I’m sure you know, there are many aspects that go into the acquisition of a commercial real estate property or a note purchase. From selection and pricing to due diligence and closing, things often pop up which can ultimately change (or derail) a deal. We most certainly stand by the motto that all parties should be forthcoming, transparent and realistic… but in the case of nonperforming loan (NPL) transactions this is often functionally impossible.

Although it has slowed since the depths of the downturn, the secondary market for selling performing loans and NPL is enormous, and the most common transactions consist of large portfolios traded between institutions. As you can imagine, when a portfolio trades, a prodigious mountain of information on each individual asset transfers along with it, and portions of this information may not always be current… or even existent. In our experience, the smaller the deals are, the less reliable or available the information tends to be. This often leads to smaller notes sitting on the books of institutions for months or years while the collateral languishes with the borrower or in receivership, often diminishing in value due to mismanagement, neglect, vandalism and disrepair.

In what could lovingly be referred to as a “tertiary” loan sale market, institutions usually turn to small/midsized funds, investment groups or Loan Sale Advisors (LSA) like Rhenium Capital to divest the smaller stuff on the open market. It is at this point of price discovery that the lack of information, transaction complexity and the expectations of the buyers (“WE WANT A DISCOUNT!”) and sellers (“WE WANT PAR!”) tend to differ the most.

Particularly for NPL’s, many things come into play that are much more subjective:

- The borrower’s willingness to comply vs. fight (and the state’s foreclosure laws in both cases)

- Rights waived in any modification or forbearance agreements

- Judgments or bankruptcies

- The reason why the loan went bad & how it affects the value

- Other factors that may have not have been considered due to the lack of current information

As an example, we recently worked on a note sale collateralized by a distressed multifamily property in a dense urban area. The borrower had gone dark for some time. The lender’s value expectations where based on a property condition assessment (PCA) and appraisal performed at loan origination. Some of the property’s units were vacant and uninhabitable (which is likely why the lender had not foreclosed). The Lender more recently obtained a broker’s opinion of value (BOV) for the property which was horribly inaccurate and void of any actionable intel, as usual.

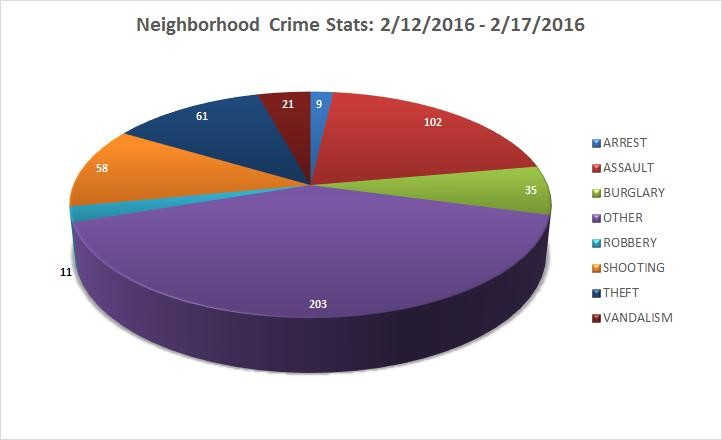

Analyzing the history of the transaction, it turns out that the borrower had purchased the property with the intention of renovating it, however he was not locally based and attempted to manage the process from 5 states away. In reviewing what was actually going on in the neighborhood, it also appeared that he may have purchased the apartment at the top of the last cycle sight unseen (which surprisingly is not as uncommon as it should be). Within a quarter mile of the asset, the unbelievable crime statistics were as follows in a short 5 day time-frame:

There were some 500 crime incidents reported within 1 week! 58 shootings in the neighborhood, many of the 203 “Other” reports entailed suspects with guns, and the 61 arrests were all drug related offenses. It turns out that the local police and the FBI were regularly conducting joint raids in order to curb the local gang violence and illicit drug trade. For the sake of transparency, we brought this to the both the note buyer and seller’s attention in our Catalyst report:

There were some 500 crime incidents reported within 1 week! 58 shootings in the neighborhood, many of the 203 “Other” reports entailed suspects with guns, and the 61 arrests were all drug related offenses. It turns out that the local police and the FBI were regularly conducting joint raids in order to curb the local gang violence and illicit drug trade. For the sake of transparency, we brought this to the both the note buyer and seller’s attention in our Catalyst report:

“The collateral property is distressed due to the asset condition: unfinished and abandoned renovations, further requirements to cure deferred maintenance (such as replacing all of the galvanized steel piping and removing friable ACM) and low occupancy. The sub-market is also distressed due to an unprecedented violent crime rate which appears to be an ongoing problem in the [REDACTED] neighborhood, and has even been identified as a sizeable problem warranting the use of resources by federal law enforcement. As such, the subject collateral is suffering from a significant and incurable negative externality.”

Both the seller and buyer (neither of whom were local) were entirely unaware of this massive issue affecting the value of the collateral, and in turn the note sale transaction. Needless to say this issue was not mentioned in the BOV, appraisal or PCA.

NPL’s are a fascinating asset class, and there is huge upside potential if you know exactly what you are getting into. Interested investors must conduct a deep dive into the history of the deal, the profile of the borrower, and the current legal status of the loan. You also need multiple exit strategies and contingency plans due to the numerous parties involved. These complexities are often compounded by a lack of asset level information. If you are currently purchasing NPL’s or considering it, you should reach out to us to discuss our Catalyst reports. They are hands down the fastest and most accurate way to analyze and value both the collateral and the note in NPL transactions.